estate tax exemption 2022 build back better

Web Under the current tax laws the estate gift and generation-skipping transfer tax exemptions are already scheduled to be cut in half from the current level of 117. A reduction in the federal estate tax.

Tax Proposals Under The Build Back Better Act Version 2 0

Web In short the proposed Build Back Better Act BBBA does the following.

. Web The prior version of the Build Back Better bill included an acceleration of this reduction of the exemptions to January 1 2022. Web President Bidens Build Back Better Bill is still being drafted in Congress. Web A reduction in the federal estate tax exemption amount which is currently 11700000.

The New York estate tax threshold is 592 million in 2021 and 611 million in 2022. Lowering the gift and estate tax exemptions seems a lock. The estate tax exemption is adjusted for inflation every year.

Meanwhile the IRS has released its 2022 annual adjustments to various tax provisions. This means that if you pass away in 2022 and your estate is valued at this. Web estate tax exemption 2022 build back better Saturday June 4 2022 Edit.

Web 2022 Annual Adjustments for Tax Provisions. Would eliminate the temporary increase in exemptions. Web The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to.

Revise the estate and gift tax and treatment of trusts. Web Three versions of the Build Back Better Act have attempted to make significant changes to current gift estate and trust income tax law. This was anticipated to drop to 5 million adjusted for inflation as of.

Effective January 1 2022 the BBBA reduces the gift estate and GST tax exemptions from. Web The Tax Cuts and Jobs Act the Act increased the federal estate tax exclusion amount for decedents dying in years 2018 to 2025. Web Due to inflation the estate tax exemption has risen this year to 126 million dollars.

Web The current estate and gift tax exemption of 2022 is 1206000000 or 2412000000 for a couple. The good news on this front is that the reduction of the estate and gift. That means an individual can leave 1206 million to heirs and pay no federal.

The BBBA proposal seeks to reduce. Web Gift and Estate Taxes Proposed Under the Build Back Better Act. Web The official estate and gift tax exemption climbs to 1206 million per individual for 2022 deaths up from 117 million in 2021 according to new Internal.

Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022. Transfer tax exemption for lifetime gifts death transfers and generation-skipping transfers. The size of the estate tax exemption.

The exclusion amount is for. Build Back Better Inflation Impact Biden Tax Plan Tax Foundation Two New Income. Web The estate and gift tax exemption at the federal level for 2022 is 1206 million per individual.

Web The package proposed reducing the current 117 million estategift tax exemption by 50 percent on January 1 2022 eliminating the use of valuation discounts. Web On September 13 the House Ways and Means Committee released its plan to pay for the 35 trillion Build Back Better Act with a variety of changes across the tax. Web New York Estate Tax Exemption.

One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption. Web Act BBBA The Build Back Better Act BBBA. There is still a step-up in basis for inherited property and.

Web The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5. Web The federal estate tax exemption for 2022 is 1206 million. Web Estate Taxes.

That number will keep going up annually.

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

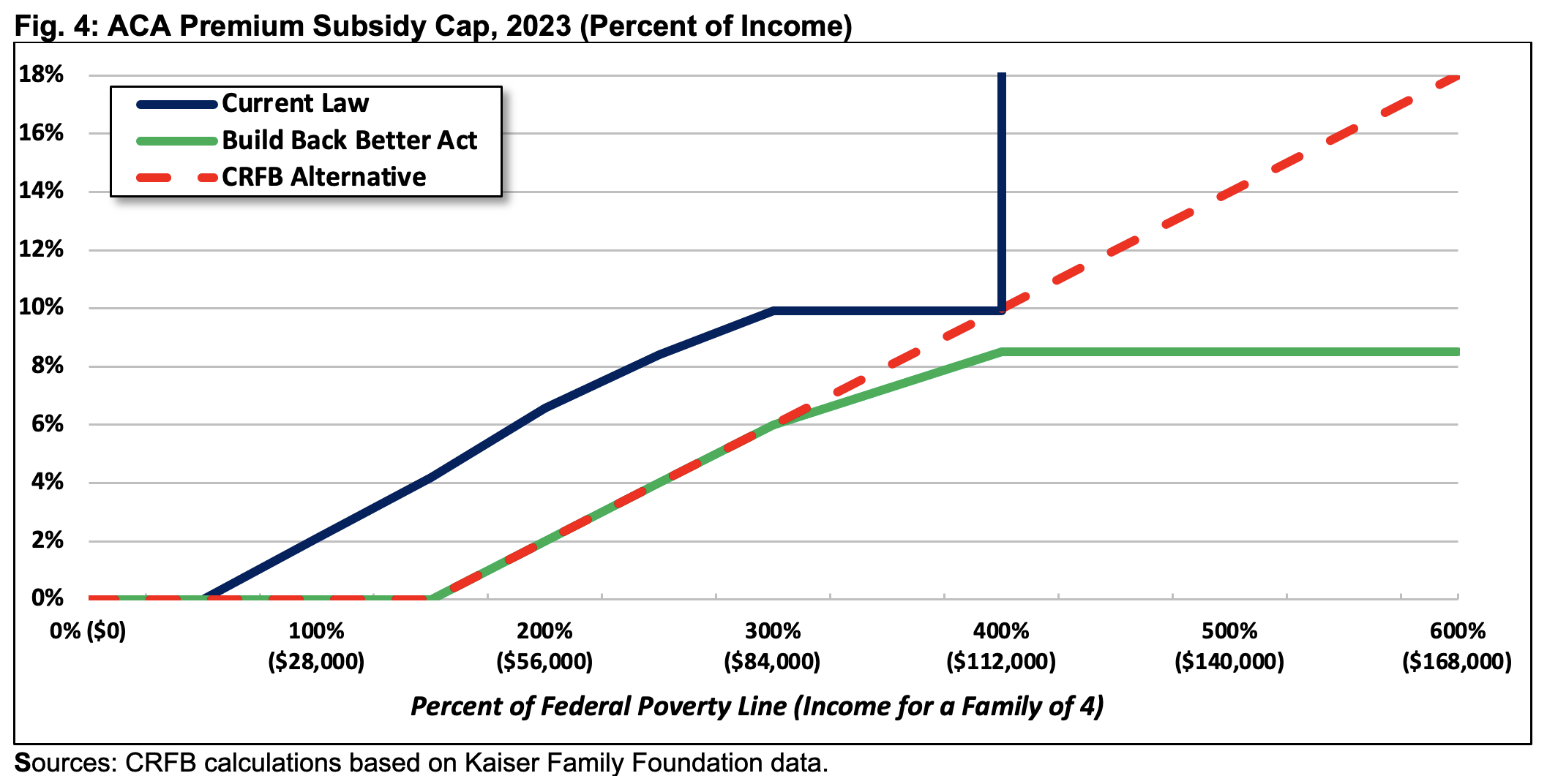

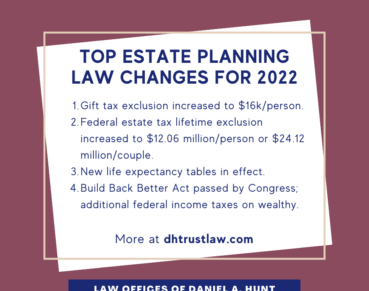

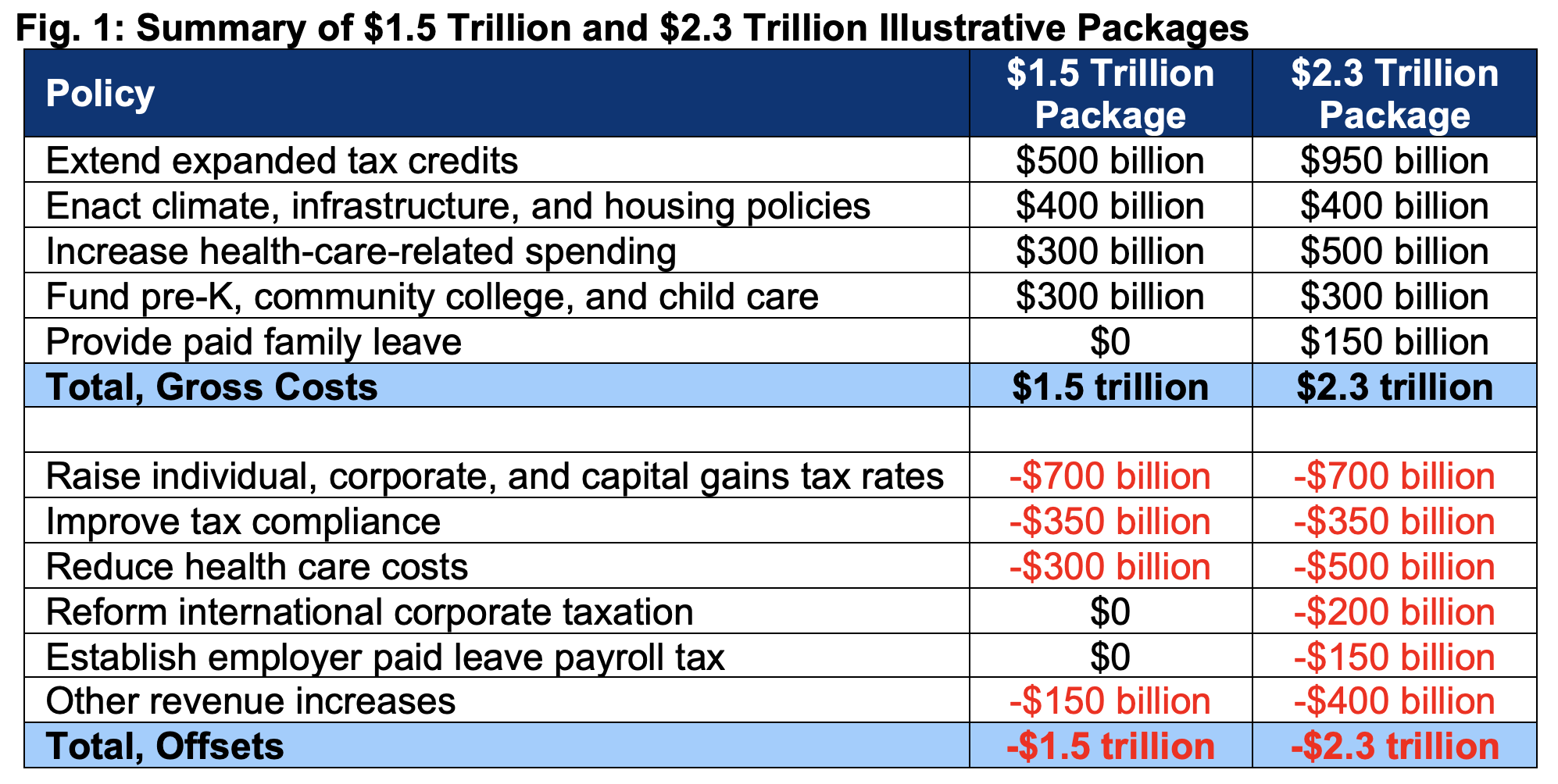

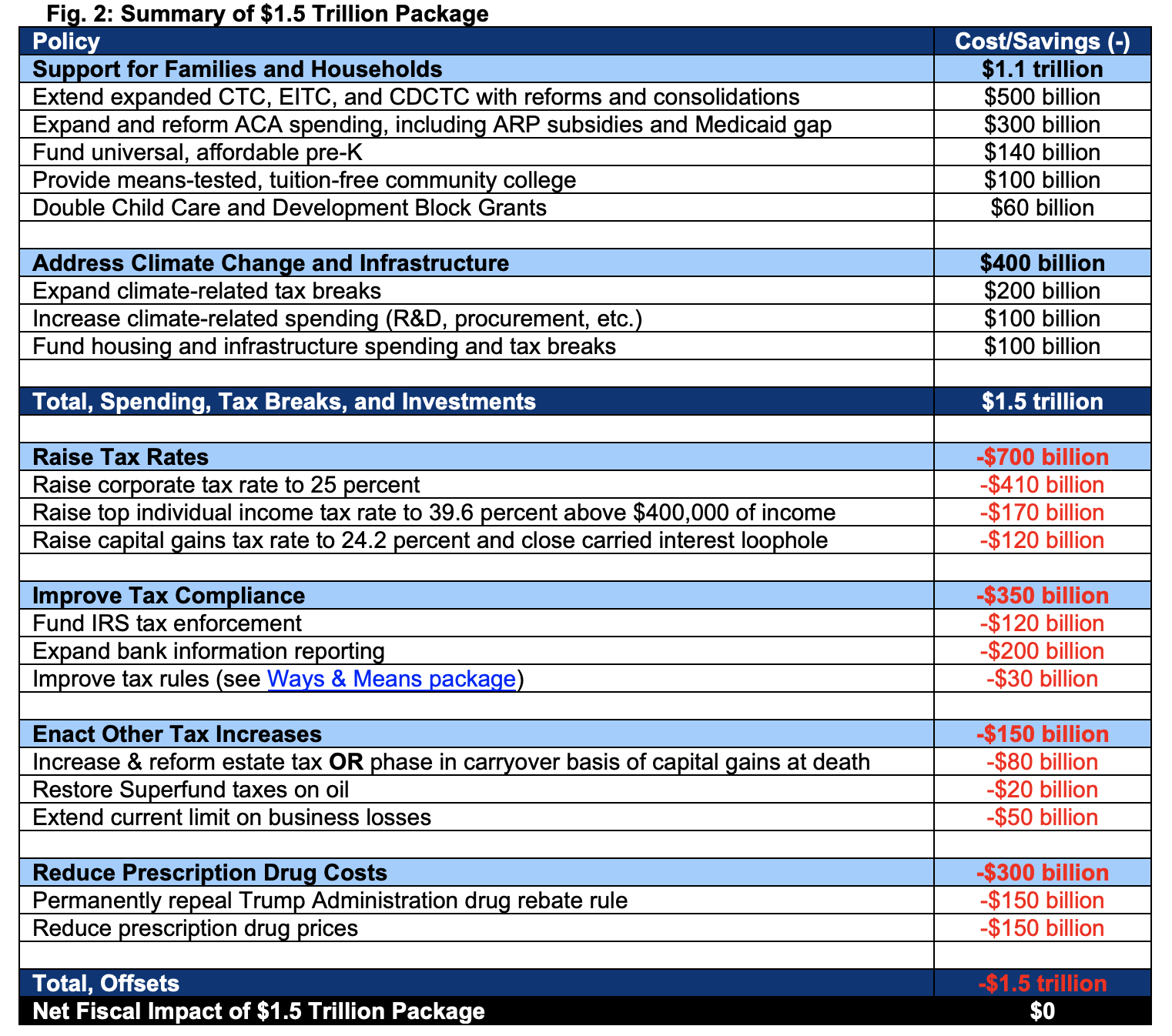

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

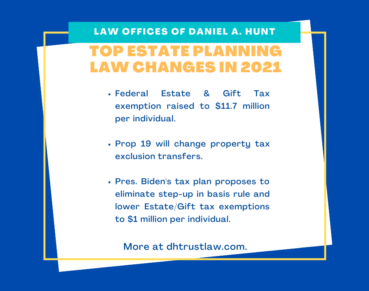

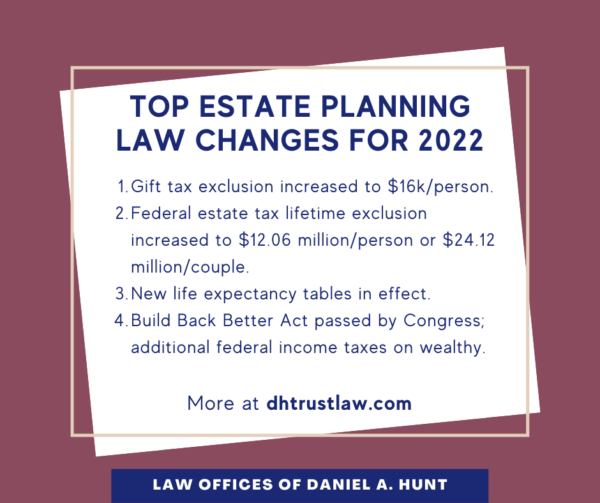

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Will 2022 Bring New Tax Law Center For Agricultural Law And Taxation

Build Back Better Act Trusts And Estates

Build Back Better Estate Tax Planning Impacts

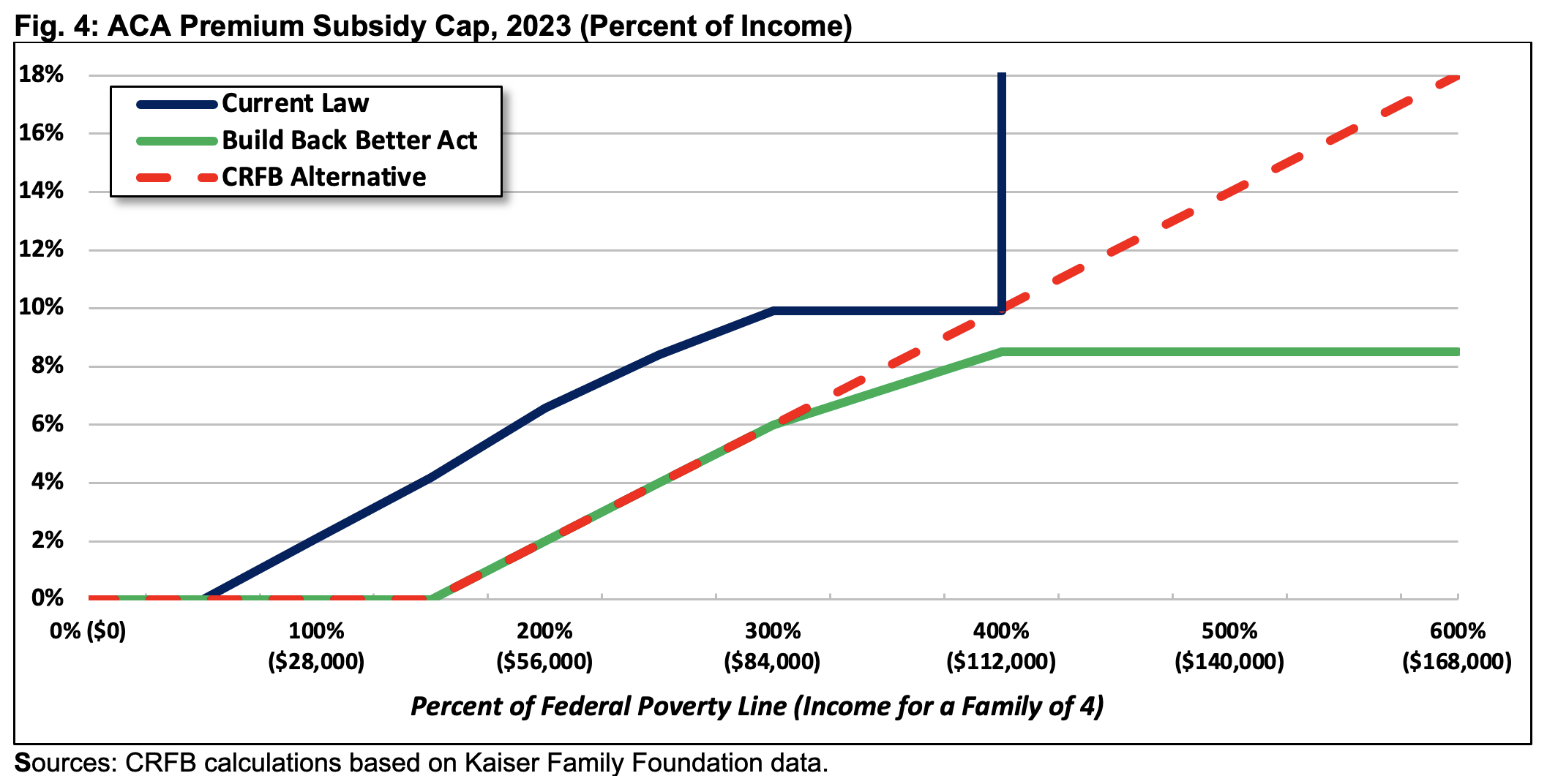

Top Estate Planning Law Changes For 2021 Law Offices Of Daniel A Hunt

What The Build Back Better Act Could Mean For Life Insurance Trusts Wealth Management

Green Book Details President S Tax Reform Proposals Center For Agricultural Law And Taxation

The Build Back Better Act The Senate Bill True Partners Consulting

Build Back Better Act Gift And Estate Tax Changes Davis Wright Tremaine

2022 Updates To Estate And Gift Taxes Burner Law Group

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

The Build Back Better Tax Plan Tax Changes Pbmares Blog

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

What Happened To The Expected Year End Estate Tax Changes

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Top Ten Estate Planning And Estate Tax Developments Of 2021 The American College Of Trust And Estate Counsel